- smcafe124's Newsletter

- Posts

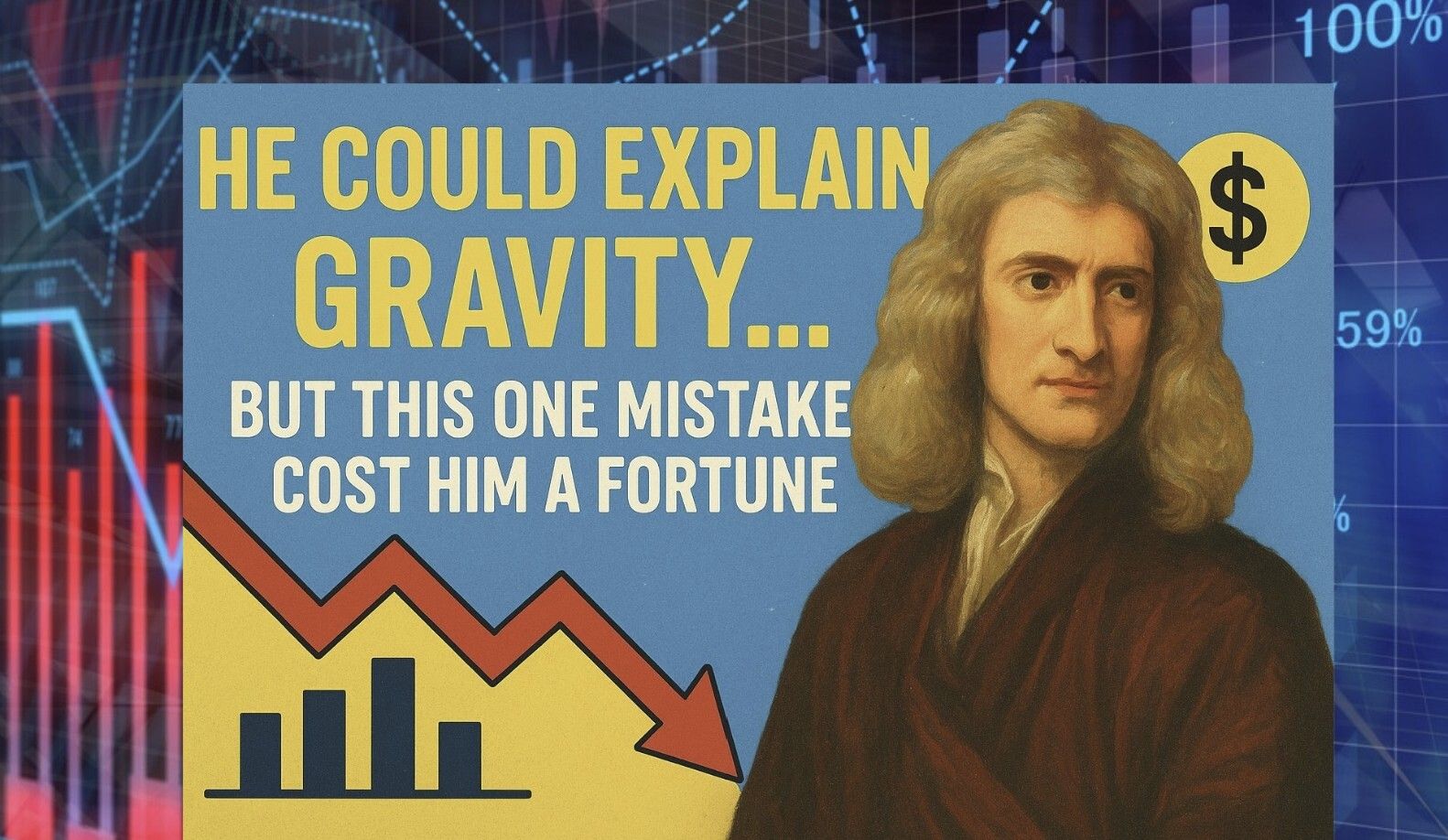

- What Newton’s Loss Teaches Us (That Charts Won’t)

What Newton’s Loss Teaches Us (That Charts Won’t)

Markets don’t punish stupidity—they punish emotion

Hi there,

When you hear the name Isaac Newton, you probably think of a genius.

“Gravity”, “Calculus”, “Laws of motion”.

What don’t you think of?

👉 A man who lost a fortune chasing a stock bubble.

Yet in 1720, that’s exactly what happened.

And the lesson?

It’s painfully relevant to every investor today—especially in markets that pump, dump, and repeat.

📜 The Trade That Broke a Genius

A perfect case study of herd mentality—300 years before Reddit and Twitter

Newton invested in the South Sea Company, a hyped British stock promising riches from trade in South America.

At first, he did everything right.

✨ Early win

He bought early… Sold early… And locked in a 100% profit.

Smart move, right?

Then the market kept going up.

Friends got richer. Prices went parabolic. The crowd was euphoric.

And Newton thought… “What if I sold too soon?”

So he did what many investors still do today 👇

🔥 He chased the rally.

He re-entered at much higher prices.

Then the bubble burst.

💥 The stock collapsed.

💥 His profits vanished.

💥 A large part of his wealth went with it.

“I can calculate the motions of the heavenly bodies, but not the madness of the people.” - Isaac Newton

This Story Matters so much for Modern Investors

🐑 Herd mentality is timeless

Even one of the smartest humans in history couldn’t resist the crowd. Intelligence doesn’t protect you from FOMO.

⏱️ Re-entering is riskier than exiting

Selling early hurts the ego.

Buying back higher hurts the portfolio.

😱 Emotions beat logic in real money situations

Knowing the theory is easy.

Executing calmly when prices explode? That’s the real skill.

🎯 Concentration kills

Newton bet too much on one speculative idea.

One bubble. One story. One outcome.

Why This Story Still Matters in Today’s Market

Replace “South Sea Company” with meme stocks, crypto hype, or hot AI plays

Sound familiar?

🚀 Stocks that “can only go up.”

📢 Everyone on social media is bragging

😬 Fear of being left behind

🤯 Buying because “everyone else is making money.”

Different century.

Same psychology.

That’s why at SM Cafe, we keep hammering this truth:

Successful investing isn’t about being clever.

It’s about being disciplined.

☕ The SM Cafe Way: Outsmarting the Crowd Without Being a Genius

Here’s what Newton didn’t have—but you do 👇

🧘 Rules that remove emotion

📉 Strategies that work in up, down, and sideways markets

🛡️ Risk management before returns

⏳ Patience instead of prediction

Because when markets go crazy…

👉 The calm investor survives.

👉 The disciplined investor compounds.

👉 The emotional investor becomes a lesson for others.

Even if his name is Isaac Newton.

🚨 Final Thought

If brilliance alone made people rich, Newton would’ve retired comfortably.

But markets don’t reward IQ.

They reward behavior.

And that’s exactly what we focus on at SM Cafe —

Helping everyday investors think independently, manage risk, and stay sane when the crowd loses its mind ☕📊